Savings Kickstart: Starting Your Journey from Ground Zero

I’ll never forget the moment I confronted the reality of my savings as an adult. Three months into my post-graduate life, I found myself stuck at home during a national lockdown. Months after months, my savings dwindled, and I found myself helpless in facing the global hiring freeze. When I finally secured a job, the burning questions consumed me, “How do I even begin saving money?” You’ve come to the right place if you’re in a similar situation.

While building an emergency fund is often emphasised as the first step towards financial stability, what if you have nothing in your bank account and creating an emergency fund feels like a distant dream? I’ve been there, especially during the challenging times of the pandemic. Initially, it seemed overwhelming, but as I took small steps in the right direction, I realised that building a comfortable safety net wasn’t as tricky as I had imagined. So, if you’re just starting your savings journey, there’s no need to panic. There’s still ample time; I promise you, it’s much EASIER than it appears. Look at the steps below for an overview of how I began saving money and laying the foundation for financial security.

Evaluate Your Spending First Before Saving

Financial experts have emphasised the significance of having a budget, but creating one can be difficult if we don’t know where our money is going. To tackle this issue, I found that beginning with evaluating our expenses is a more straightforward approach.

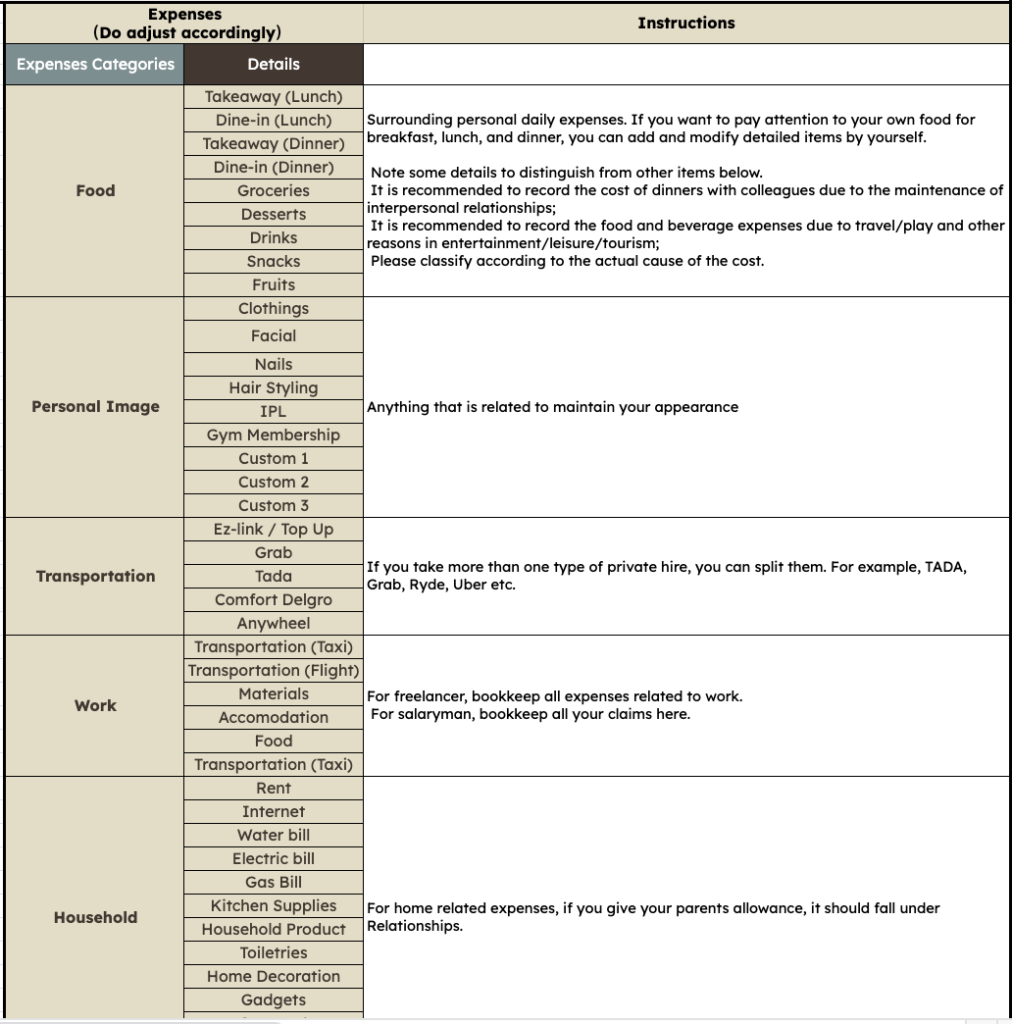

To better manage my finances, I set aside an evening each month to review my bank statements and credit card transactions from the past month. If you’re new to this, reviewing the last six months of statements is best. I focus on recurring subscriptions or memberships I don’t use often. I categorise my spending into ten areas to better understand where my money is going and identify areas where I can reduce my spending. These categories include food, personal appearance, transportation, household expenses, education, leisure activities, healthcare, debts, and credit card expenses. I believe that making small lifestyle changes can greatly impact how much you can save. For example, if you’re an intern with a limited income, it may be challenging to save a lot of money due to living expenses.

Your Motivation To Saving

I find it helpful to set specific goals to stay on track with my finances. Without a clear target, getting sidetracked and spending money on unnecessary items is easy. I make every purchase a conscious decision by creating a goal for an emergency fund or a set amount to save by a certain date. I ask myself if it’s worth spending the money or if it’s better to save it to get closer to my goals.

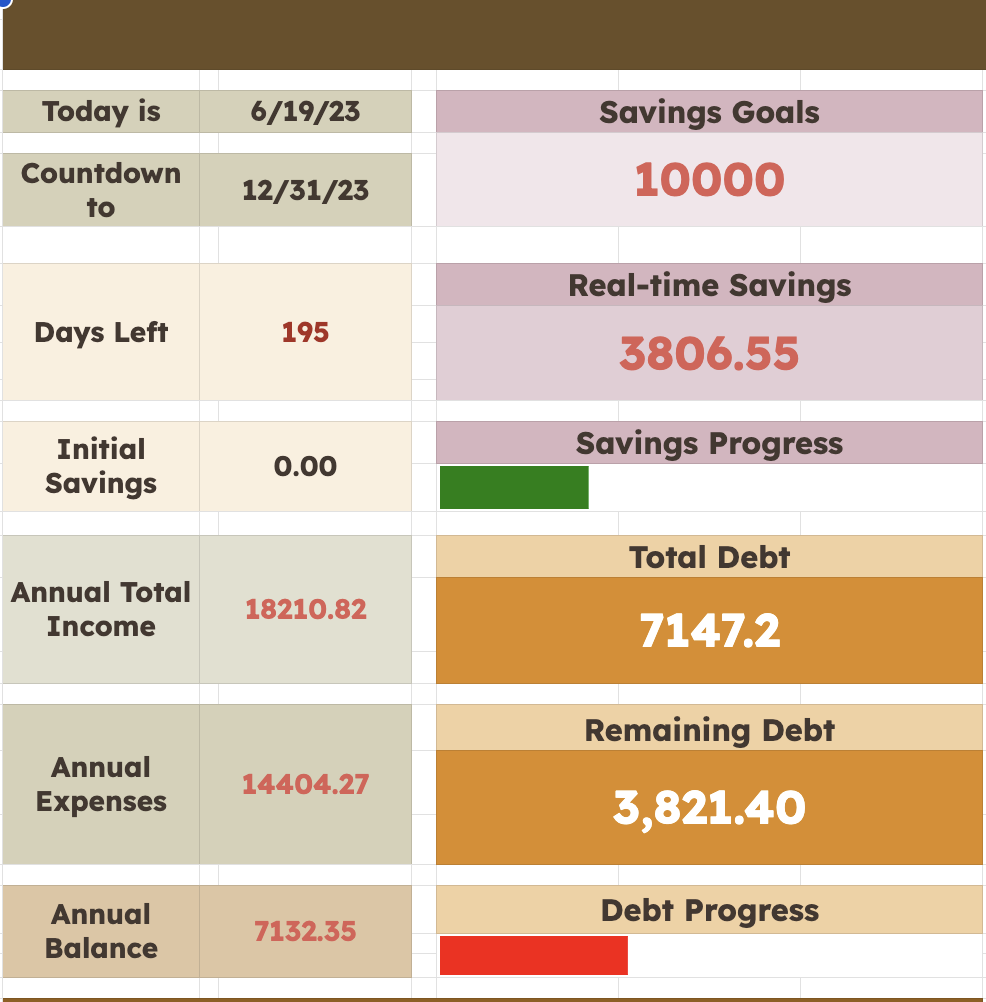

Having visible goals gives me an extra push. I track my progress with a dashboard in Excel and keep a vision board on my desktop to remind me daily that I’m working towards something and hold myself accountable. Once I have a goal in mind, the next step is…

Save Faster By Paying Myself First

As a full-time hustler, I have an irregular income, so I make it a priority to take care of myself first. Whenever I receive money, no matter the amount, I always set aside a portion for savings before taking care of other financial obligations. It hasn’t always been easy, and there have been some months where it was challenging to stick to this commitment. During those times, budgeting has been crucial in helping me overcome the obstacles.

Creating A Budget

Once I have identified your savings goals and spending habits, it’s time to create a budget. There are many budgeting methods available, such as the 50-30-20 system, zero-based budgeting, or systems provided by budgeting apps. Regardless of the method, the main aim is to determine the fixed costs (like rent and transportation) and variable costs (like groceries and entertainment) to find areas where I can save money.

I personally divide my expenses into ten categories: food, personal image, transportation, household, learning, leisure, medical, favours, debts, and credit card. After analysing my spending habits for the past six months, I set my budget for each category 10% lower than my expenses. This helps me to reevaluate my variable costs and determine which ones I need to add to my budget or cut out.

By creating a budget, I can also determine the minimum amount of income I need to sustain my lifestyle. If I cannot earn enough to meet my needs, I will adjust my budget and cut down expenses while still prioritising saving a portion of my income.

More Income Means More Savings

One way to improve your financial situation is by finding additional sources of income or increasing your salary. You can consider temporarily taking on extra shifts at work until you have enough saved for emergencies or look for freelance projects to work on regularly. Personally, I took on a project management job to save for my goals, and it helped me hit my target savings number faster. Starting small by finding ways to save $10 or $20 can also make a significant impact on your savings over time. By labelling the money you earn from your additional work as savings, you can easily track where your money goes.

Taking steps towards saving money can seem daunting at first, but with a little effort and commitment, it is entirely achievable. By analysing your spending patterns and setting clear goals, you can prioritise your savings and create a well-crafted budget. Exploring new opportunities to increase your income and embracing small steps will help you witness the transformative power of savings unfolding before your eyes. So, embrace this exciting path towards financial security and know that every effort you make is worth it in the end.